History Of Banking in India

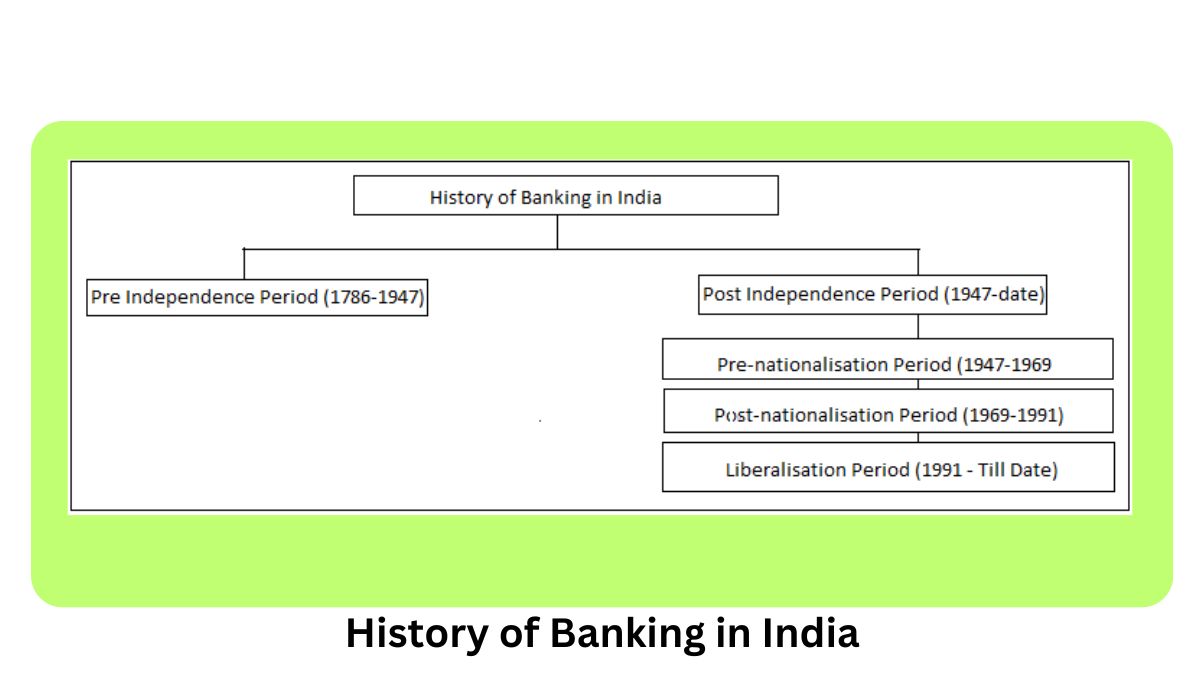

The evolution of banking in India is a fascinating journey that reflects the country’s socio-economic transformations. The banking sector has undergone significant changes from the colonial period to post-independence, the liberalisation phase to modern-day advancements. The following are the various phases of the evolution of banking in India and how it brought drastic changes to the economy. Let’s see history of banking in India.

- How To Become Financially Independent Without Doing Traditional Job in 2024

- National Domestic Product (NDP)

- Gross National Product (GNP)

- Understanding of NNP (Net Nation Product)

- 15 FAQ on Personal Finance

History Of Banking in India: Pre-Independence Period (1786-1947)

- Banking in India originated in the last decades of the 18th century with the establishment of the General Bank of India in 1786 by Warren Hastings, followed by the Bank of Hindustan.

- The British East India Company had an immense influence on the banking sector and thus formed three presidency banks: Bank of Bengal, Bank of Bombay, and Bank of Madras.

- In 1921, these banks were merged into one entity known as the Imperial Bank of India, which became nationalised and rebranded as the State Bank of India in 1955.

History Of Banking in India: Post-Independence Period (1947-1991)

- India had to face the challenge of reconstructing her economy immediately after independence in 1947.

- The nationalisation1949 brought it under control to obtain greater control over monetary policy and banking regulations.

- The government nationalised 14 central commercial banks in 1969, followed by another six in 1980, to have a better distribution of credit and resources.

History Of Banking in India: Liberalisation Period (1991-Present)

- The liberalization of the economy, which took place in 1991, saw the banking sector enter a new era in India.

- The government undertook various reforms to promote competition, efficiency, and innovation in the banking sector.

- Private and foreign banks acquired more freedom and were allowed to operate on a level playing ground, promoting competition with better customer services.

- Technology came in, and the era of digital banking entirely revolutionized the sector into something accessible and easy to deal with.

List of 14 Banks nationalised in 1969, 1980

- Allahabad Bank

- Bank of India

- Bank of Baroda

- Bank of Maharashtra

- Central Bank of India

- Canara Bank

- Dena Bank

- Indian Overseas Bank

- Indian Bank

- Punjab National Bank

- Syndicate Bank

- Union Bank of India

- United Bank

- UCO Bank

Apart from the above mentioned banks, there were seven subsidiaries of SBI which were nationalised in 1959:

- State Bank of Patiala

- State Bank of Hyderabad

- State Bank of Bikaner & Jaipur

- State Bank of Mysore

- State Bank of Travancore

- State Bank of Saurashtra

- State Bank of Indore

In the year 1980, another 6 banks were nationalised. These banks included:

- Andhra Bank

- Corporation Bank

- New Bank of India

- Oriental Bank of Comm.

- Punjab & Sind Bank

- Vijaya Bank

Effects of Independence on the Banking Sector

- Independence brought about regulatory frameworks, as well as the nationalization of key banks.

- Improved government intervention promoted inclusive growth.

- The new focus was on rural banking, agricultural financing, and extending the bank’s services to the underbanked areas

Role of Banking in BFSI Sectors

- Banking becomes the skeleton of the Banking, Financial Services, and Insurance (BFSI) domain.

- Banks help provide financial services through products like credit, savings, and investments.

- They act as intermediaries between savers and borrowers in the economy so that resources are allocated efficiently.

- Banks support other financial institutions and markets within the BFSI ecosystem.

The Positive Effects of Nationalisation

- Nationalization increased the banking network, particularly in the rural regions and among weaker sections of society.

- Nationalized banks played a very vital role in the implementation of various schemes and policies of the government.

- They promoted financial inclusion by providing banking services to hitherto unbanked populations.

Drawbacks of Nationalisation

- Increased government influence in banks created unnecessary bureaucracy and political intrusion.

- Sometimes, the social objectives focus led to poor financial performance and accumulation of non-performing assets (NPAs).

- Lack of competition in the nationalized banking sector ensured that there was no innovation or efficiency within it.

Types of Banks in India

- Public Sector Banks

- Private Sector Banks

- Foreign Banks

- Regional Rural Banks (RRBs)

- Cooperative Banks

- Small Finance Banks

Each type of bank performs different tasks in the financial system and delivers each of those services for people, businesses, and communities across the country.

Evolution of Private Banks in India

Private banking in India has a long history, with the first bank established during the pre-independence period being a private entity. Over time, many of these private banks were nationalized to ensure equitable financial opportunities across society. The landscape of private banking saw significant growth post-2000, with the emergence of new banks such as Kotak Mahindra Bank, Yes Bank, and IndusInd Bank. The advent of digital transformation globally has significantly enhanced customer experience in private banking. Advanced technologies now enable seamless online banking services, UPI transactions, and more, contributing to the robust growth of the banking sector in India. Today, the country boasts a plethora of private banks.

History of Private Banking in India

| Bank Name | Headquarters | Established in the Year |

|---|---|---|

| Axis Bank | Mumbai, Maharashtra | 1993 |

| Bandhan Bank | Kolkata, West Bengal | 2015 |

| CSB Bank | Thrissur, Kerala | 1920 |

| City Union Bank | Thanjavur, Tamil Nadu | 1904 |

| DCB Bank | Mumbai, Maharashtra | 1930 |

| Dhanlaxmi Bank | Thrissur, Kerala | 1927 |

| Federal Bank | Aluva, Kerala | 1931 |

| HDFC Bank | Mumbai, Maharashtra | 1994 |

| ICICI Bank | Mumbai, Maharashtra | 1994 |

| IndusInd Bank | Mumbai, Maharashtra | 1964 |

| IDFC FIRST Bank | Mumbai, Maharashtra | 2015 |

| Jammu & Kashmir Bank | Srinagar, Jammu and Kashmir | 1938 |

| Karnataka Bank | Mangaluru, Karnataka | 1924 |

| Karur Vysya Bank | Karur, Tamil Nadu | 1916 |

| Kotak Mahindra Bank | Mumbai, Maharashtra | 2003 |

| IDBI Bank | Mumbai, Maharashtra | 1964 |

| Nainital Bank | Nainital, Uttarakhand | 1922 |

| RBL Bank | Mumbai, Maharashtra | 1943 |

| South Indian Bank | Thrissur, Kerala | 1929 |

| Tamilnad Mercantile Bank | Thoothukudi, Tamil Nadu | 1921 |

| YES Bank | Mumbai, Maharashtra | 2004 |

Conclusion: History Of Banking in India

The history of banking in India is a fascinating journey marked by significant milestones and transformations. From its early inception with indigenous banking systems such as “Seths” and “Sahukars,” the Indian banking sector has evolved remarkably. The establishment of the Bank of Hindustan in 1770 heralded the formal banking era, followed by the foundation of the General Bank of India and the Presidency Banks. The post-independence period saw the nationalization of major banks in 1969, a move aimed at fostering financial inclusion and economic stability.

The liberalization of the 1990s introduced private and foreign banks, enhancing competitiveness and innovation. The advent of digital banking and financial technologies in recent years has revolutionized the banking experience, making it more accessible and efficient. Today, India’s banking system is robust, catering to diverse economic needs while striving for inclusivity and growth. The sector continues to adapt to global trends, ensuring it plays a crucial role in the nation’s economic development.

Frequently Asked Questions (FAQs)on History of Banking in India

1. When was the first bank established in India?

The first bank in India was the Bank of Hindustan, established in Calcutta by Alexander and Co. in 1770. It operated for about 50 years before being liquidated between 1830 and 1832.

2. What led to the nationalization of banks in India?

The nationalization of banks in India was primarily driven by the need to ensure a wider spread of credit, control private monopolies over banking, and ensure that sufficient credit is available for agriculture, small industry, and exports. The government aimed to make banking more inclusive and align it with the socialistic goals of economic policies at that time.

3. How did the Reserve Bank of India come into existence?

The Reserve Bank of India (RBI) was established on April 1, 1935, based on the recommendations of the 1926 Royal Commission on Indian Currency and Finance, also known as the Hilton Young Commission. It was initially privately owned but was nationalized in 1949 .

4. What are the major banking reforms that took place post-1991 economic liberalization?

Post-1991, major banking reforms in India included liberalization of banking regulations, reduction of statutory liquidity ratios, introduction of prudential norms for asset classification and income recognition, and capital adequacy requirements. These reforms aimed to enhance efficiency, competitiveness, and stability in the banking sector.

5. How has digital banking evolved in India?

Digital banking in India started in the late 1990s and early 2000s with basic online services like balance inquiries and fund transfers. The RBI set up a committee on computerization in banks in 1988, leading to the adoption of IT, LAN connectivity, and Core Banking platforms. Today, digital banking includes ‘digital banking units’ and post offices integrated with the core banking system.